Paris Gold Project

PARIS GOLD PROJECT: A PREMIER ASSET IN WESTERN AUSTRALIA’S GOLDFIELDS

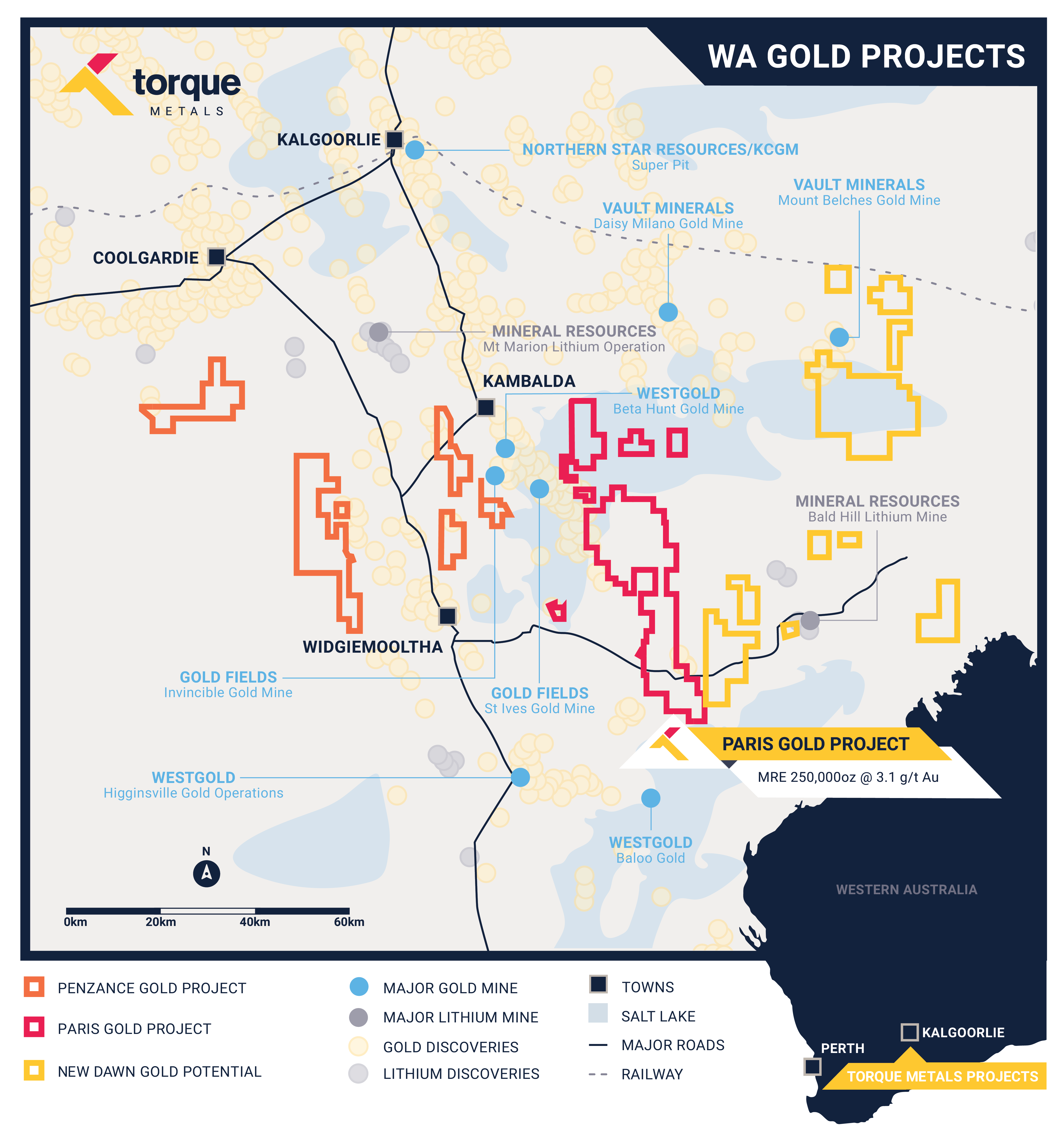

The Paris Gold Project is a prime asset located in the heart of the Western Australian gold belt, covering 700 km² of highly prospective land. Positioned 12 km southeast of Goldfields’ St Ives project and 10 km east of Westgold’s Higginsville project, it benefits from proximity to key processing facilities including the Higginsville and St Ives mills.

Situated on the prolific Boulder-Lefroy Fault, this world-class gold province is surrounded by other significant projects, such as Northern Star Resources’ Super Pit, Goldfields’ Invincible, and Karora Resources’ Beta Hunt and Baloo operations.

ALL TIME HIGH-GRADE INTERCEPTS UNDERPIN THE HIGHLY PROSPECTIVE PARIS GOLD PROJECT

Best Results Include:

- 35m @ 14.12 g/t Au from 157.85m including 1.2m @ 185 g/t Au from 174.7m; 4.44m @ 20.82 g/t Au from 170.3m; 2.49m @ 40.6 g/t Au from 167.8m; (23PRCDD076)

- 15m @ 12.57 g/t Au from 215m including 1m @ 22 g/t Au from 216m; 1m @ 75 g/t Au from 217m; 1m @ 79 g/t Au from 228m; (24PRC160)

- 39m @ 6.05 g/t Au from 175m including 9m @ 10.66 g/t Au from 178m; 3m @ 29.4 g/t Au from 202m; (22PRC053)

- 41m @ 5.93 g/t Au from 188m including 3m @ 59.35 g/t Au from 204m; 2m @ 25.54 g/t Au from 189m; (21PRC056)

SIGNIFICANT EXPLORATION INFORMING A ROBUST FIRST-PASS MINERAL RESOURCE ESTIMATE

Torque has conducted more than 25,000m of drilling completed (diamond and reverse circulation) over the past 3 years.

Exploration results highlight the rich gold endowment, with grades indicating a 2.5 km gold camp potential. High-grade zones remain open to the northwest, southeast, and at depth. Consistent metallurgical recovery rates of over 96% have been achieved since the start of exploration.

As the company undertakes a focused drilling campaign, efforts are centred on expanding the spatial extent of the gold-mineralised zone and exploring adjacent parallel structures identified through advanced geophysical imaging and machine learning algorithms.

These exploration efforts have yielded outstanding results, confirming strong gold mineralisation at the Paris Gold Project and reinforcing its significant potential for future development.

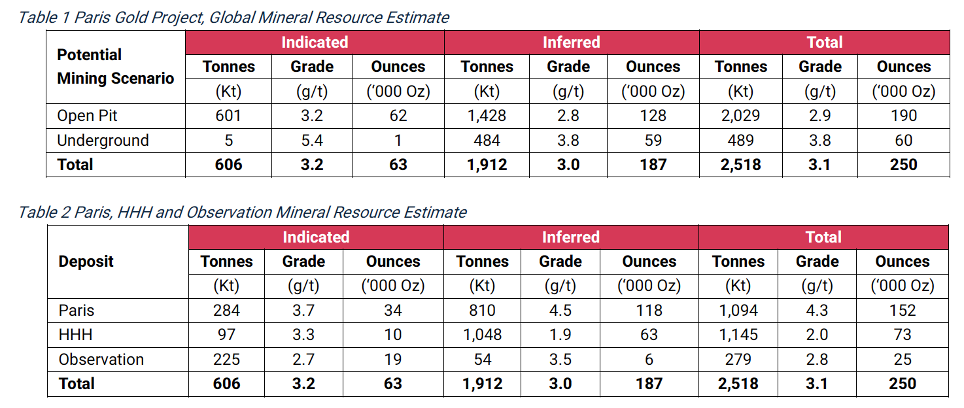

The Mineral Resource Estimate (MRE) completed for Paris Gold Project is 2,518Kt @ 3.1g/t gold for 250,000 ounces. This comprises:

- 1,094Kt @ 4.3g/t gold for 152,000 ounces – Paris Deposit

- 1,145Kt @ 2.0g/t gold for 73,000 ounces– HHH Deposit

- 279Kt @ 2.8g/t gold for 25,000 ounces – Observation Deposit

RESOURCE CLASSIFICATION BREAKDOWN AT THE PARIS GOLD PROJECT’S PARIS, HHH AND OBSERVATION DEPOSITS

Resource Classification breakdown for Paris Deposit includes:

- 284Kt @ 3.7g/t gold for 34,000 ounces (22%) classified as Indicated and 810Kt @ 4.5g/t gold for 118,000 ounces (78%) classified as Inferred.

Resource Classification breakdown for HHH Deposit includes:

- 97Kt @ 3.3g/t gold for 10,000 ounces (14%) classified as Indicated and 1048Kt @ 1.9g/t gold for 63,000 ounces (86%) classified as Inferred.

Resource Classification breakdown for Observation Deposit includes:

- 225Kt @ 2.7g/t gold for 19,000 ounces (76%) classified as Indicated and 54Kt @ 3.5g/t gold for 6,000 ounces (24%) classified as Inferred.

The Paris MRE is a shallow, high-recovery gold resource (>96%), with open-pit mining potential (190,000 ounces @ 2.9g/t open pit, 60,000 ounces @ 3.8g/t underground) based on a gold price of A$3,000/ounce.

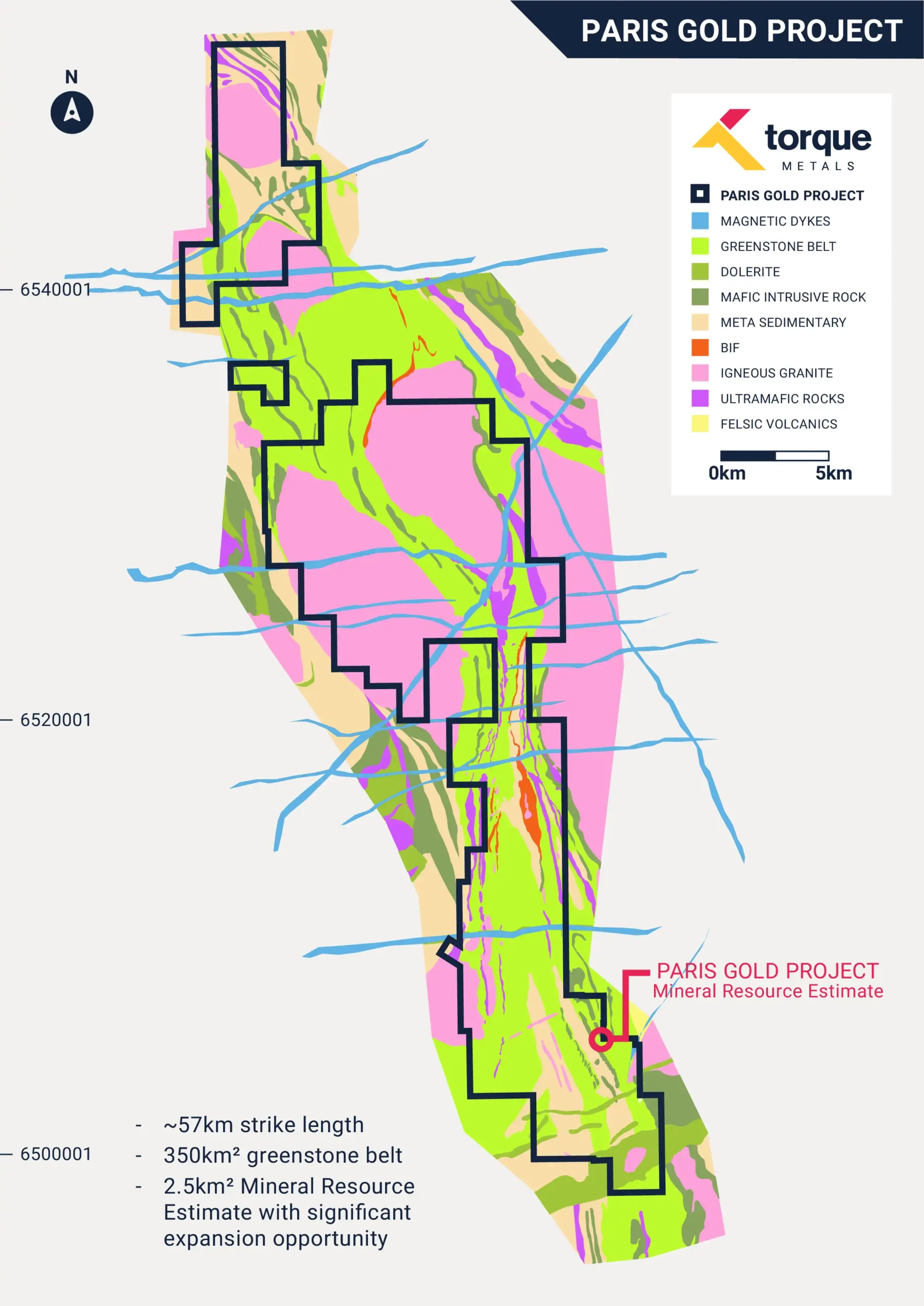

The Paris MRE pertains to only 2.5km² tested of the 350km² area controlled by Torque, with mineralisation open in all directions, strong signs of linking structures and mineralisation identified both outside and next to resource area presenting strong potential for growth through further exploration.

Unlocking New Potential At Paris Gold Camp

The Paris Gold Project continues to demonstrate its potential as a robust and promising asset, strategically positioned on the Boulder-Lefroy Fault—a major geological structure known for its rich mineral deposits. Leveraging advanced geological modeling techniques, the project has unveiled significant opportunities for expansion and further resource definition.

A shallow discovery named Eva was o made in a previously untested 1.5km gap between the HHH and Paris pits. This discovery suggests that the two prospects may be connected. The drill campaign showed occurrences of mineralisation along ~500m, including:

- 16m @ 4.19 g/t gold from 66m, including 2m @ 13.12 g/t gold from 72m and 2m @ 18.91 g/t gold from 80m in 24HRC087.

- 12m @ 1.2 g/t gold from 99m, including 3m @ 2.52 g/t gold from 99m

- 12m @ 4.29 g/t gold from 69m, including 3m @ 16.1 g/t gold from 69m

- 12m @ 1.37 g/t gold from 72m, including 3m @ 2.68 g/t gold from 78m

- 9m @ 1.01 g/t gold from 36m, including 3m @ 2.43 g/t gold from 42m and 6m @ 1.11 g/t gold from 101m

Initial metallurgical testing conducted by Independent Metallurgical Operations Ltd (IMO) on samples from the Paris and Observation prospects in 2023 highlighted substantial recoverable gold through gravity concentration—yielding 40.7% recovery for Paris and 39.9% for Observation.

Comminution tests indicated medium ore hardness, with Bond Ball Work Index values of 13.6 kWh/t for Paris and 9.5 kWh/t for Observation. Furthermore, cyanide leaching achieved outstanding gold recoveries of 96.7% for Paris and 99.7% for Observation.

In 2024, Torque Metals again engaged IMO to conduct metallurgical testing, consciously selecting composites from intervals with higher concentrations of potentially deleterious elements.

The intention behind this decision was to establish an encompassing range of expected gold recoveries.

Notably, despite the composition of these ore composites, leaching performance did not appear to be adversely affected and therefore gold recovery through standard cyanide leaching methods is unlikely to be impeded.

2024 gravity recoverable gold at Paris was reported as 57.6%, 68.8% at HHH, and 51.8% at Observation; emphasising the deposits’ quality.

Combined gold recoveries were equally impressive, with Paris achieving an average of 96.1%, HHH reaching 96.5%, and Observation achieving 90.9%.

A dominant shallow to moderate southeast-striking to north-northwest-striking set, associated with the dominant foliation (termed S4; Jones et al., 2019) and the development of the bulk of veining, shear zones and most recorded fault/breccia zones (likely developed at a later stage). This set of structures represents the main controls on gold mineralisation. This orientation is strike-parallel to the Talcum Fault, (east-west direction) which separates the Boorara Domain from the Parker Domain, hinting at the possible reactivation of early regional architecture.

A secondary shallow to moderate north-northwest-striking set, associated with veining and some shear and fault zones. This orientation is not associated with any recorded foliation but also represents the main controls on gold mineralisation in the north (HHH, Observation). This orientation is also strike-parallel to the Talcum Fault.

A minor moderate to steep west-southwest-striking set, associated with only very few veins but with some major shear zones, locally logged as ‘foliation’, also parallel to the regional domain boundaries associated with a dolerite with ultramafic affinity to the west and felsic intrusive rocks to the east. This orientation may either play a role in controlling or remobilising gold mineralisation.

Gold occurs as structurally and host-rock controlled lodes, sharply bounded by high-grade quartz veins and associated lower-grade haloes of sulphide-altered wall rock. Mineralisation occurs in all rock types, although Fe-rich dolerite and basalt are the most common, and large granitic bodies are the least common hosts. Most mineralisation is accompanied by significant alteration, generally comprising an outer carbonate halo, intermediate to proximal potassic-mica, albite alteration and inner sulphide zones. The principal control on gold mineralisation is structure, at different scales, constraining both fluid flow and deposition positions.

Torque has also identified two distinct styles of mineralisation. The first style includes early shear-related quartz veins and breccia zones north south direction, while the second comprises high-grade, parallel shear-related gold mineralisation trending in a west-east direction.

Torque’s in-house technical team has developed a comprehensive lithostructural model that integrates geological, structural, and geophysical data. This model has proven instrumental in predicting mineralised zones, optimising drilling strategies.

Significant gold intersections, such as 48m @ 1.37 g/t gold from 72m in hole 24PRC106, including 9m @ 2.6 g/t gold from 78m and 3m @ 9.23 g/t gold from 105m, underscore the model’s effectiveness. This approach has revealed potential connections between the Paris and HHH pits, confirming extensions of gold-rich structures in multiple directions within the Paris gold camp.